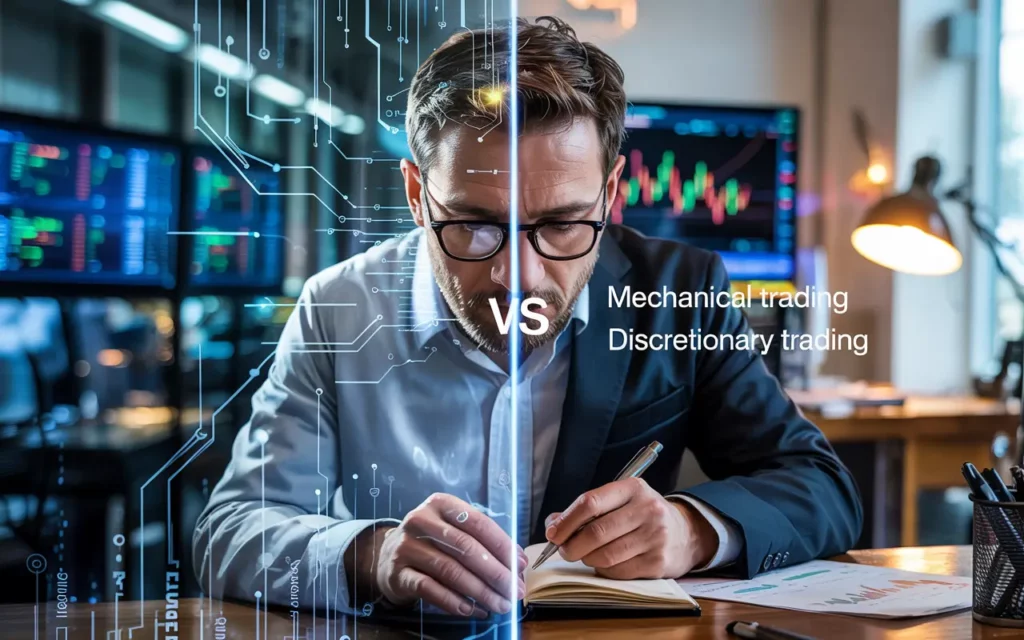

Choosing the right trading approach is key to success. We’ll look at mechanical and discretionary trading. Each has its own strengths and weaknesses.

Mechanical trading uses rules and algorithms. It’s all about being consistent and objective. On the other hand, discretionary trading relies on your gut feeling and flexibility. It’s for those who like to make decisions based on their own judgment.

Knowing the differences between mechanical and discretionary trading helps you choose the best strategy. It depends on your skills and what you want to achieve. For more insights on how markets behave, check out this article on accumulation, manipulation, and distribution.

Introduction to Trading Styles

Learning about different trading styles is key to doing well in the financial markets. Each style fits different people and how much risk they can take. You’ll find two main styles: mechanical and discretionary trading.

Mechanical trading uses set rules, often with the help of computers. This way, emotions don’t get in the way, making it consistent. Discretionary trading, however, lets you use your own judgment. You mix technical and fundamental analysis to decide when to trade.

Looking into these styles can help you find what works best for you. Knowing if you like a strict plan or a flexible approach is crucial. This choice is important for your success in trading.

What is Mechanical Trading?

Mechanical trading uses rules and algorithms for trading. It helps traders avoid emotional decisions by focusing on data. This method is great for those who like to follow rules and be consistent.

It involves testing strategies with past data and creating strong trading systems. These systems are made for specific markets. If you’re interested in starting with a funded account, visit the Instant Funded page.

i. Definition and Overview

Mechanical trading means trades are made automatically based on set rules. It helps traders stay calm and avoid emotional choices. By using automated systems, traders can quickly analyze data and make trades without worry.

ii. Key Components of Mechanical Trading

- Rule-Based Strategies: Every mechanical trading system is built on specific rules that dictate when to enter and exit trades.

- Backtesting: This process involves testing trading strategies on historical data to understand their potential effectiveness.

- Risk Management: Essential to any trading system, effective risk management techniques help protect your capital and control losses.

- Automated Trading Systems: These systems execute trades automatically based on the defined rules, allowing for trades to occur without manual intervention.

Understanding Discretionary Trading

Discretionary trading is a flexible way to trade. It lets you make choices based on your own thoughts and the market. You don’t just follow rules or algorithms. Instead, you use both your gut and analysis in your trading.

i. Definition and Overview

Discretionary trading means traders make choices based on their own insights. It’s different from automated systems that stick to rules. This way, you can change your strategy as the market changes and based on your own judgment.

This flexibility can make trading more enjoyable. It lets you feel more connected to the market.

ii. Key Components of Discretionary Trading

- Market Analysis: You collect info from many places, like technical indicators and news, to guide your choices.

- Intuition: Having a good feel for the market can help you make quick trades.

- Risk Management: It’s important to adjust your risk based on your comfort and the market’s ups and downs.

- Adaptability: Discretionary trading lets you quickly change your strategy when the market surprises you.

- Personal Experience: Your past trading and how you feel can greatly affect your decisions.

Mechanical Trading vs Discretionary Trading

Trading has two main ways: mechanical and discretionary. Each has its own rules and ways of making decisions. Mechanical trading uses set rules and algorithms for trades. This makes trades consistent but might not be flexible.

Discretionary trading lets traders use their gut and experience. It’s good for adapting to market changes. But, emotions can make results unpredictable. Knowing the good and bad of each helps pick the right strategy for you.

| Feature | Mechanical Trading | Discretionary Trading |

|---|---|---|

| Decision Process | Rule-based | Intuition-based |

| Consistency | High | Varies |

| Flexibility | Low | High |

| Emotional Influence | Minimal | Significant |

| Time Requirement | Low (automated) | High (active monitoring) |

Neither method is always better. Your choices, how much risk you take, and your life style matter. Mixing the best of both helps make a trading plan that fits you. For more details about trading rules, visit our FAQs section.

Benefits of Mechanical Trading

Mechanical trading has many benefits. It helps you trade better in the financial markets. It makes your trading consistent and based on rules.

This way, you make decisions without letting emotions get in the way. This is key for traders to stay focused and avoid mistakes.

i. Consistency and Objectivity

One big plus of mechanical trading is its consistency. You trade based on set rules, not guesses. This stops you from second-guessing yourself.

It keeps you from making quick, emotional decisions. This leads to more stable and reliable trading over time.

ii. Automated Trading Strategies

Another great thing is automated trading strategies. Once set up, trades happen without you needing to do anything. This saves time and makes your trades more precise.

Algorithms make decisions based on current data. They find opportunities you might miss. This makes your trading more disciplined and effective.

Advantages of Discretionary Trading

Discretionary trading has many benefits. It lets you move quickly in changing markets. You use your skills to understand market moves, giving you an edge.

This way of trading is flexible. It lets you make choices based on what you see. Many traders find this appealing.

i. Flexibility and Adaptability

Discretionary trading is all about being flexible. You can quickly respond to market changes. This is key in fast-changing markets.

Traders who know market trends can grab quick chances. This shows the big plus of discretionary trading.

ii. Utilizing Human Intuition

Your gut feeling is important in discretionary trading. It’s different from systems that just follow rules. You use your knowledge and feelings to make decisions.

This adds a special touch to your trading. It makes your choices more effective.

Comparing Trading Strategies

When looking at different trading ways, it’s key to know the difference between rule-based and decision-based trading. Each has its own good points and bad points that can really change how well you do in trading. Rule-based trading sticks to set rules, making trades systematic. Decision-based trading uses your gut and can change with the market.

i. Rule-Based Trading vs Decision-Based Trading

Rule-based trading uses algorithms or patterns to decide when to trade. It’s all about being consistent, following the rules always. Decision-based trading lets you use your own judgment, changing plans as the market does.

| Feature | Rule-Based Trading | Decision-Based Trading |

|---|---|---|

| Structure | Predefined criteria and rules | Personal judgment and flexibility |

| Execution | Automated systems | Manual decision-making |

| Emotional Influence | Minimized | Potentially high |

| Performance Consistency | High consistency | Variable outcomes |

ii. When to Use Each Approach

Deciding between rule-based and decision-based trading depends on your experience and the market. Rule-based trading is good for those who like a simple, systematic way and works well in calm markets. Decision-based trading is better in wild markets where quick changes and your own insights matter. Knowing when to use each can help you reach your trading goals.

Trading Psychology in Different Approaches

Knowing about trading psychology is key for both discretionary and mechanical trading. Emotions can greatly affect your choices, especially with manual trading. We’ll look at how emotions impact discretionary trading and how to stay disciplined in mechanical trading.

Emotional Factors in Discretionary Trading

In discretionary trading, emotions are very important. Feelings like fear and greed can make you act without thinking. This can hurt your trading plan. It’s important to know these emotions to manage them better.

- Fear of Missing Out (FOMO): The urge to enter a trade quickly to avoid missing a potential profit.

- Loss Aversion: The tendency to hold onto losing trades out of fear of further losses.

- Overconfidence: The belief that you can consistently predict market movements, leading to increased risks.

Using mindfulness and journaling can help keep your mind balanced. This can also make your trading better.

Maintaining Discipline in Mechanical Trading

Discipline is very important for mechanical trading. If you don’t follow your rules, your strategy won’t work well. To stay disciplined, try these:

- Stick to Your Plan: Make a clear trading strategy and stick to it.

- Regularly Review Performance: Check your trades to see how you can get better and change your strategy if needed.

- Set Realistic Goals: Have goals that you can reach. This keeps you focused and motivated.

By focusing on these, you can fight off emotional influences. This can make your trading more successful.

Implementing Successful Trading Systems

Good trading systems need solid backtesting and careful evaluation. Knowing how to check trading systems helps improve your strategy. This part talks about how to do it right.

i. Backtesting Strategies for Mechanical Trading

Backtesting is key in trading system development. It tests your strategy on past market data. Here’s how to do it well:

- Gather historical data: Good data is crucial. Use trusted sources for data over different times.

- Define your strategy: Make clear rules for when to buy or sell and how to manage risks.

- Run backtests: Test your strategy on past data to see how it did.

- Analyze results: Look at important numbers to see what works and what doesn’t, then tweak your strategy.

ii. Evaluating Discretionary Trading Techniques

Evaluating discretionary trading is different. It needs self-reflection and analysis to see how well your decisions work. Here are some tips:

- Journal trades: Write down every trade, why you made it, to spot patterns.

- Assess market conditions: Look at how your strategies do in different market situations.

- Seek feedback: Talk to trading groups for advice to make your discretionary methods better.

Choosing the Right Approach for You

Choosing a trading style is more than just knowing how to trade. It’s about knowing yourself well. Doing a self-assessment in trading can show your strengths and what you need to work on. Knowing if you like a set plan or making your own decisions is key to a good trading routine.

i. Assessing Your Skills and Preferences

Start by checking your trading skills. Think about how much risk you can take, how you make decisions, and how you handle stress. Ask yourself a few questions:

- Do you like following rules or changing with the market?

- Do you trust data or your gut more?

- How do you handle stress, and which way fits you better?

ii. Aligning Your Trading Goals with Your Style

Your goals should help pick your trading style. If you want steady, long-term gains and less stress, mechanical trading might be for you. But if you like quick wins and flexibility, discretionary trading could be better. Know what success means to you in trading. Learn more about trading goals and funded opportunities here.

Conclusion

When we look at mechanical vs discretionary trading, we see big differences. These differences can really change how you trade. Knowing these differences helps you choose the right way to trade for you.

Measuring the good points of mechanical trading, like being steady and using set plans, against the freedom and gut feelings of discretionary trading helps you decide. Your likes and what you want to achieve in trading will help you pick the best style for you.

Choosing the right trading style is very important. It should match your skills and dreams. Start exploring and let your trading style grow as you learn more in the ever-changing trading world.

FAQ

What is the main difference between mechanical trading and discretionary trading?

Mechanical trading uses rules and algorithms for trades. This makes decisions consistent and objective. Discretionary trading, however, relies on the trader’s intuition and analysis. It allows for quick changes based on market conditions.

What are the benefits of mechanical trading?

Mechanical trading keeps decisions consistent and reduces emotional influence. It uses a structured approach. This method also allows for thorough backtesting and optimization of trading rules.

Can discretionary trading be more profitable than mechanical trading?

Yes, discretionary trading can be more profitable in volatile markets. Quick adjustments based on news and insight can lead to better results. But, it can also be affected by emotions, leading to losses.

How do I choose between mechanical and discretionary trading?

Your skills, preferences, and risk comfort level decide. Mechanical trading is systematic and rule-based. Discretionary trading is based on analysis and personal insight.

What role does trading psychology play in discretionary trading?

Trading psychology is key in discretionary trading. Emotions like fear and greed can affect decisions. Understanding and managing these emotions can improve performance.

How can back testing improve mechanical trading strategies?

Backtesting uses historical data to evaluate strategies. It helps find strengths and weaknesses. This makes strategies more effective in live trading.

What are automated trading systems?

Automated trading systems use algorithms to make trades without humans. They rely on data and operate in real-time. This makes trading more efficient and reduces emotional influence.

Is technical analysis used in both mechanical and discretionary trading?

Yes, technical analysis is used in both. Mechanical trading uses indicators for signals. Discretionary traders interpret charts and data for decisions.

What are some common mistakes in mechanical trading?

Mistakes include over-optimizing systems and ignoring market conditions. Failing to adapt to changing markets can also undermine a system.

How important is discipline in mechanical trading?

Discipline is crucial in mechanical trading. It ensures following rules and avoids emotional distractions. This maximizes the effectiveness of mechanical trading.

What methods are used in discretionary trading?

Discretionary trading uses technical and fundamental analysis. It also involves human intuition and news monitoring. This adaptability allows for quick market reactions.